We will pay you 25% of the money we earn from every successful referral for landlord Insurance.

Sign up nowDepending on what part of the country you’re in you may be experiencing a residential let boom or there might be a steep decline. In a number of areas, it’s becoming a renters’ market with many looking for more space as they continue to spend more time than ever in their home. With so much unrest in the market, working with a specialist let property insurance broker can not only provide you with additional income, but also provide your landlords with a high-quality product with an extended unoccupancy period*.

We will pay you 25% of the money we earn from every successful referral. The amount you earn can vary depending on the type of client you refer and their needs.

The landlord insurance market offers landlords a lot of choice, but how do they know which is the best solution for them? In a landscape with ever-changing legislation, we offer landlords some much needed guidance through all the complications whilst making sure they have the right insurance. By introducing your landlord clients to Protect My Let, you are not only helping them to protect their investment, but also strengthening your proposition by providing some clarity in a highly saturated and complicated market for landlord insurance.

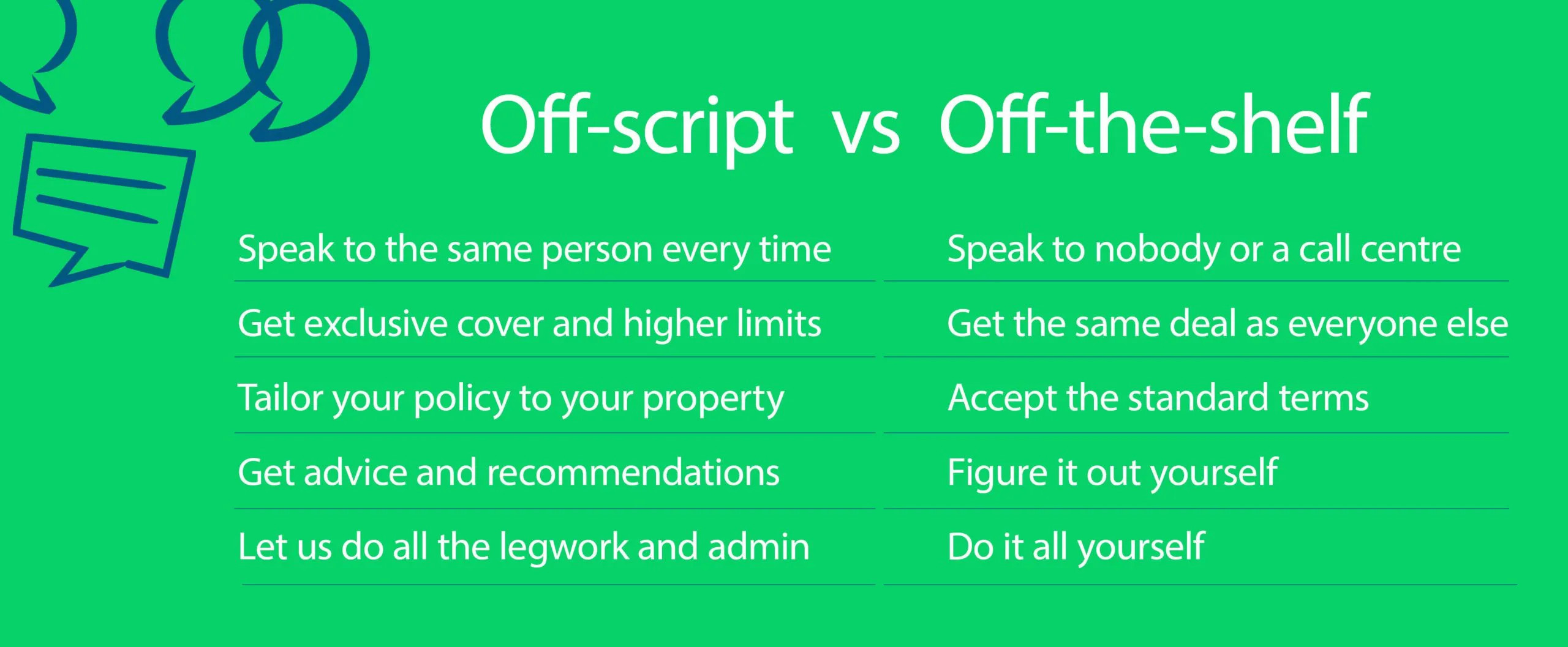

At Protect My Let we go off-script to get better landlord insurance. By this we mean we don’t stick to a phone script or just offer one insurance policy in the hope it fits all. We’re a team who only work with residential landlords. We’re all about down-to-earth advice and straightforward solutions. When a landlord talks to us, they get a real person at the end of the phone and a dedicated broker hell-bent on getting them the right cover at the right price.

All it takes is a quick introduction and you are on your way. Once you’ve been set up as an introducer, you simply have to recommend us to your clients. They can either quote your name or you can seek their permission to provide us with their details for a friendly phone call.

*The extended unoccupancy period is available if the landlord chooses our MS Amlin product which offers 90 days unoccupancy. We have a panel of insurers which each offer different products with different lengths of unoccupancy.

Working with us as an introducer means working together, which is why we’ve put together some ideas on how to maximise your role as an introducer. On this page you’ll find lots of activities you can do to raise awareness with your clients and increase lead generation.

We’re here for one purpose and one purpose only: to find you landlord insurance that’s built for your exact needs, by talking to you personally.

We’re all about down-to-earth advice and straightforward solutions. When you talk to us, you get a real person at the end of the phone and a dedicated broker hell-bent on getting you the right cover at the right price.

That’s because our team understands that all landlords are different. You might be a well-established landlord with a property portfolio, you might let to students, or you might be an accidental landlord. Whatever your let, we can protect it with the cover you actually need, not what you don’t.

And because every member of our team knows this sector inside out, we know how to get exclusive cover that gives you market-beating protection at no extra cost. We’ve been doing it since 2004.

So don’t worry about your landlord insurance – that’s what we’re here for. Just give us a call and see what we can do. You won’t regret it.

0%